Risk measures from Gaussian mixtures modeling

VaR.GMMlogreturn.RdValue-at-Risk (VaR) and Expected Shortfall (ES) from the fit of

Gaussian mixtures provided by GMMlogreturn() function.

Value

Returns a numerical value corresponding to VaR or ES at given level(s).

References:

Ruppert Matteson (2015) Statistics and Data Analysis for Financial Engineering, Springer, Chapter 19.

Cizek Hardle Weron (2011) Statistical Tools for Finance and Insurance, 2nd ed., Springer, Chapter 2.

Details

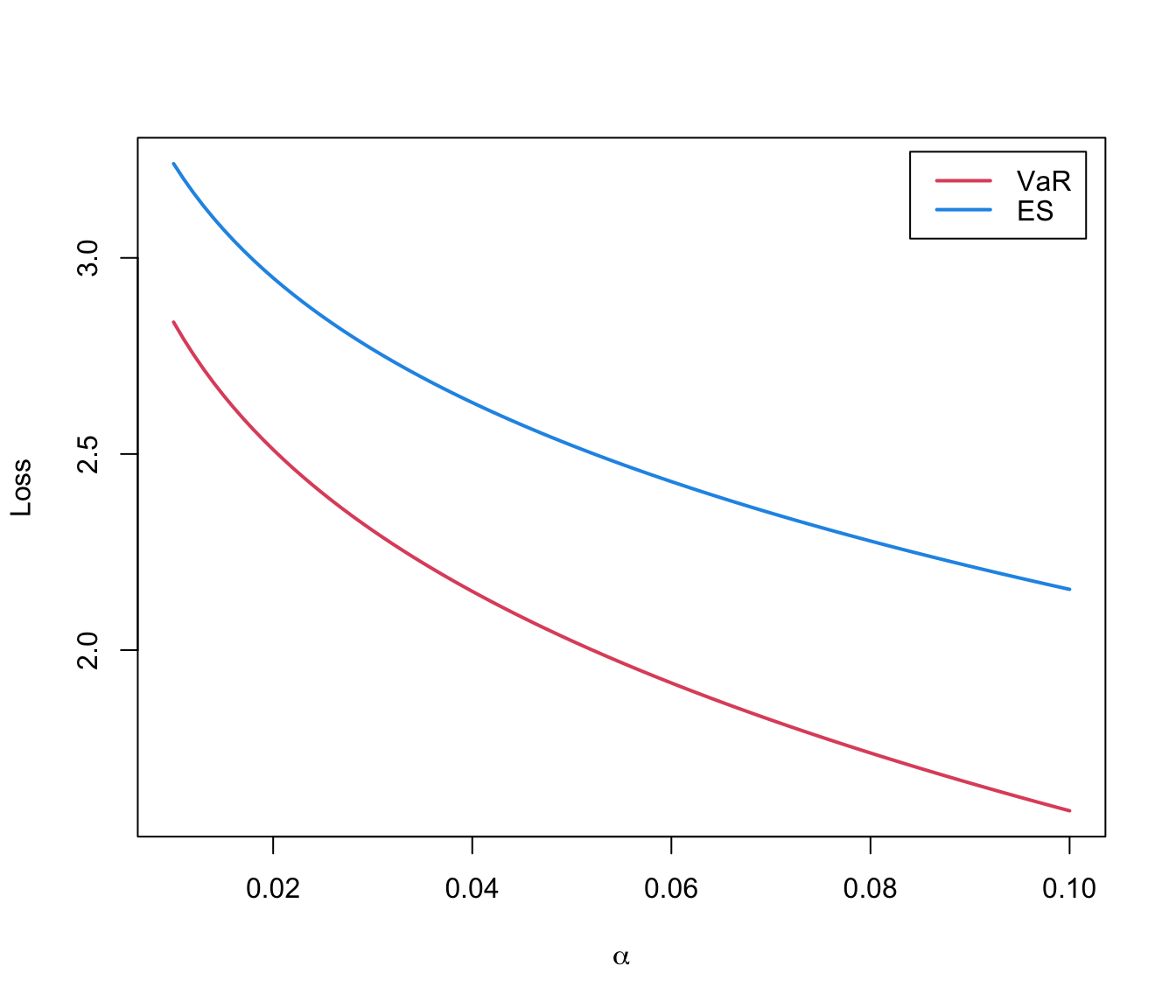

VaR(\(\alpha\)) is the maximum potential loss over a specified time horizon with probability equal to the confidence level \(1-\alpha\).

ES(\(\alpha\)) is the expected loss given that the loss exceeds the VaR(\(\alpha\)) level.

Examples

z = sample(1:2, size = 250, replace = TRUE, prob = c(0.8, 0.2))

y = double(length(z))

y[z == 1] = rnorm(sum(z == 1), 0, 1)

y[z == 2] = rnorm(sum(z == 2), -0.5, 2)

GMM = GMMlogreturn(y)

alpha = seq(0.01, 0.1, by = 0.001)

matplot(alpha, data.frame(VaR = VaR(GMM, alpha),

ES = ES(GMM, alpha)),

type = "l", col = c(2,4), lty = 1, lwd = 2,

xlab = expression(alpha), ylab = "Loss")

legend("topright", col = c(2,4), lty = 1, lwd = 2,

legend = c("VaR", "ES"), inset = 0.02)