Modeling log-returns distribution via Gaussian Mixture Models

GMMlogreturn.RdGaussian mixtures for modeling the distribution of financial log-returns.

Usage

GMMlogreturn(y, ...)

# S3 method for class 'GMMlogreturn'

summary(object, ...)Arguments

- y

A numeric vector providing the log-returns of a financial stock.

- ...

Further arguments passed to

mclust::densityMclust(). For a full description of available arguments see the corresponding help page.- object

An object of class

'GMMlogreturn'.

Details

Let \(P_t\) be the price of a financial stock for the current time frame

(day for instance), and \(P_{t-1}\) the price of the previous time frame.

The log-return at time \(t\) is defined as:

$$

y_t = \log( \frac{P_t}{P_{t-1}} )

$$

By default, a univariate heteroscedastic GMM using Bayesian regularization

(as described in mclust::priorControl()) is fitted to the observed

log-returns. The number of mixture components is automatically selected

by BIC, unless specified with the optional G argument.

References

Scrucca L. (2024) Entropy-based volatility analysis of financial log-returns using Gaussian mixture models. Entropy, 26(11), 907. doi:10.3390/e26110907

Examples

data(gold)

head(gold)

#> date log.returns

#> 1 2023-01-03 0.0109308628

#> 2 2023-01-04 0.0070955464

#> 3 2023-01-05 -0.0097625244

#> 4 2023-01-06 0.0158964701

#> 5 2023-01-09 0.0045492333

#> 6 2023-01-10 -0.0005875467

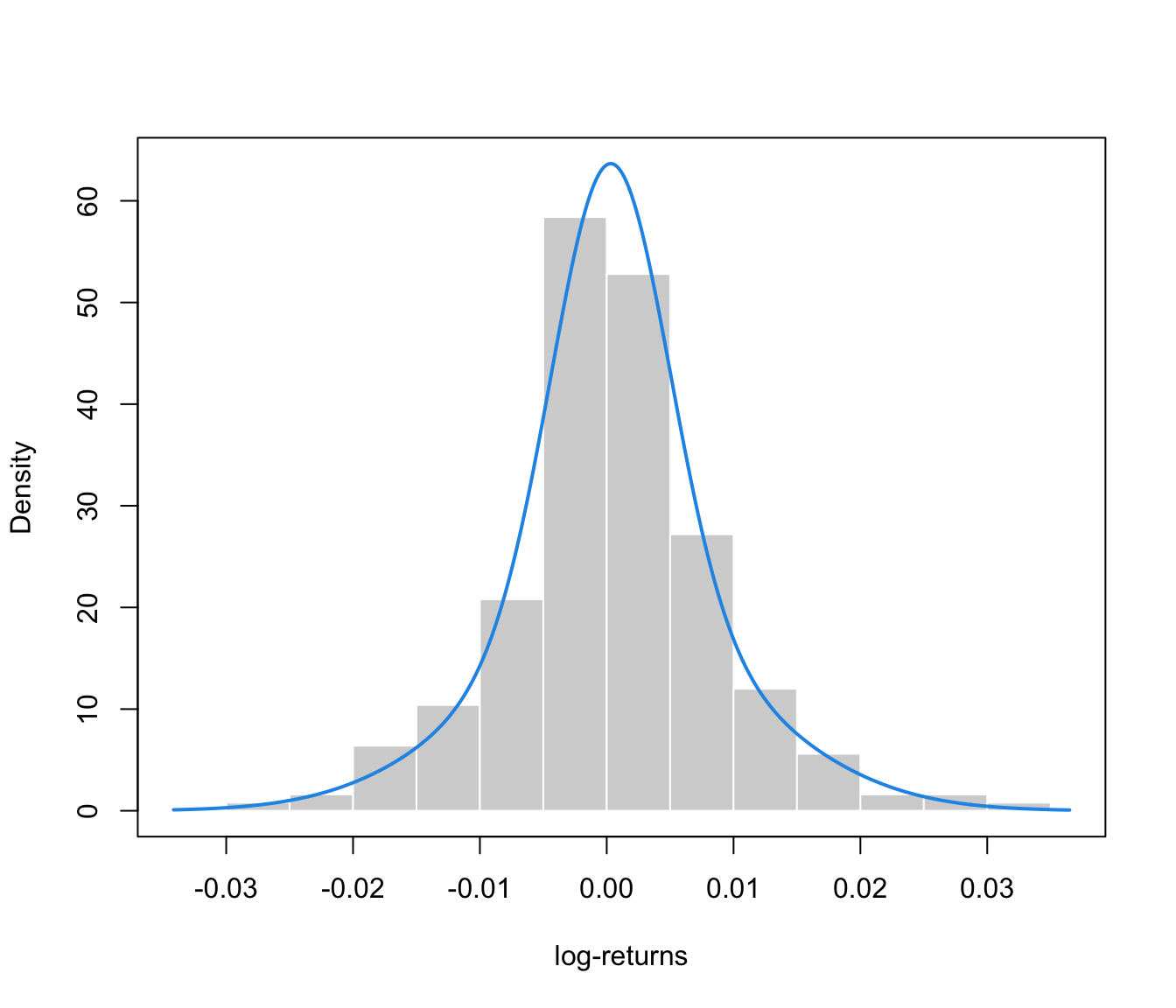

mod = GMMlogreturn(gold$log.returns)

summary(mod)

#> ── Log-returns density estimation via Gaussian finite mixture modeling ─────────

#> Model: GMM(V,2)

#> Prior: defaultPrior()

#>

#> log-likelihood n df BIC Entropy

#> 852.46 250 5 1677.3 -3.4098

#>

#> Mixture parameters:

#> Prob Mean StDev

#> 1 0.52433 0.00029069 0.0045432

#> 2 0.47567 0.00073238 0.0107633

#>

#> Marginal statistics:

#> Mean StDev Skewness Kurtosis VaR ES

#> 0.00050079 0.0081227 0.058714 4.5584 0.012877 0.017929

plot(mod, what = "density", data = gold$log.returns,

xlab = "log-returns", col = 4, lwd = 2)